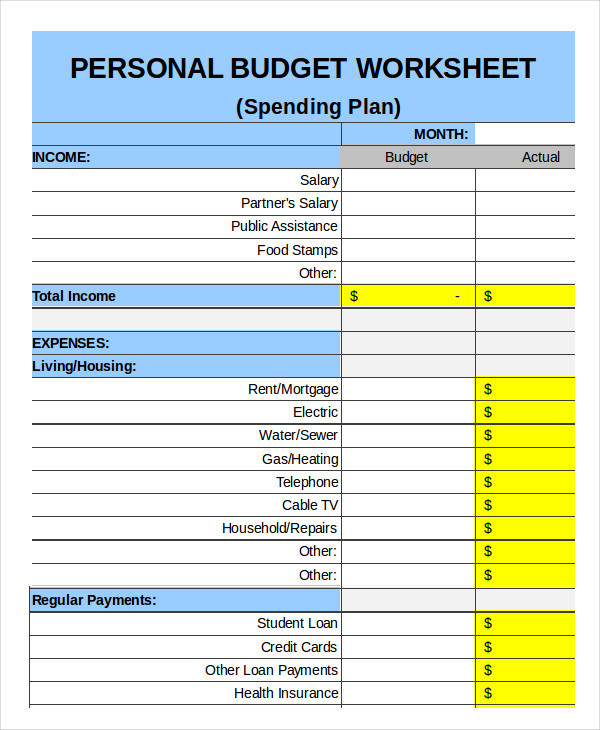

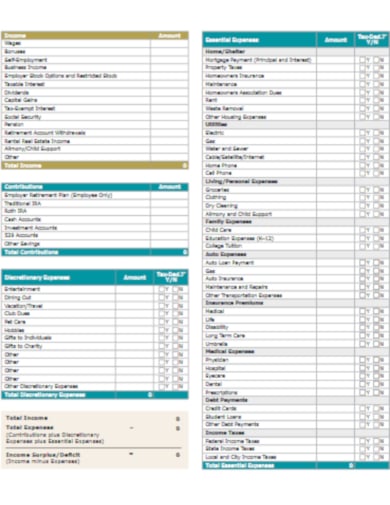

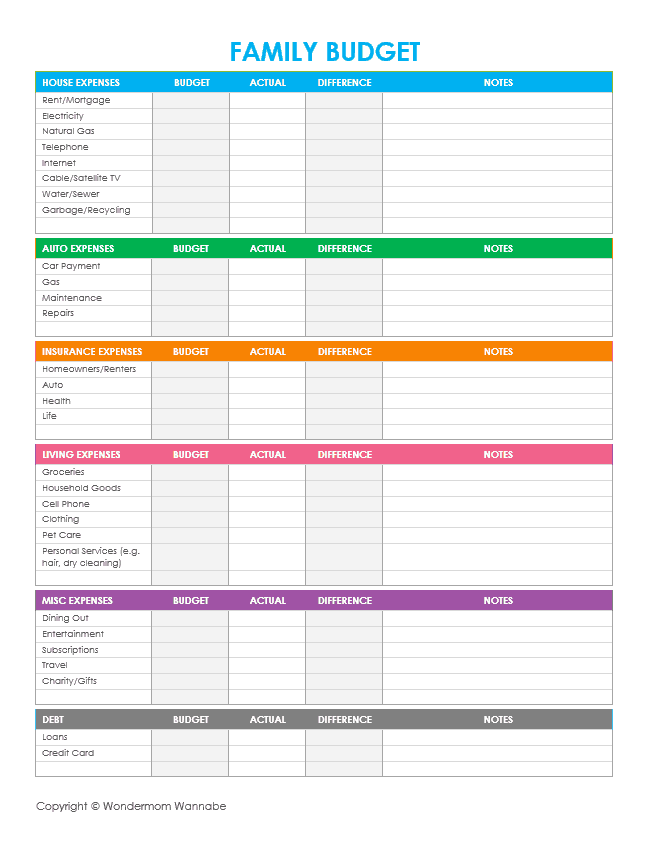

This means getting creative with some of the best ways to save money and by stretching your food budget so that it lasts the entire month. For example, if you find that you've exhausted more than half of your grocery budget and the month is only half over, then you need to make some adjustments. After all, isn't that the very reason why you created a budget? To ensure that you're staying on track, consider taking the time at the end of each week to add up your purchases or totals in each category. You're not accurately tracking all your spendingĬreating a written budget means nothing if you ignore the predetermined limits that you've set for yourself. However, if you set unrealistic goals (let's say spending only $400 a month on food), you're just setting yourself up to fail. For example, if your bank statements indicate that you typically spend $600 a month on groceries for a family of four, then cutting back to $550 a month can be a realistic goal (saving you $50 a month). If you want your budget to work, you need to be realistic about your spending. If your budget doesn't seem to be working out the way you anticipated, here are some of the possible reasons why: You've created an unrealistic plan Then keep a journal to track how much you spend in each of those categories. Personal (entertainment, shopping, clothes).Health and fitness (medical, gym membership, grooming).For example: Housing, food, auto, entertainment, savings, clothing, medical, etc. Begin by making a list of specific spending categories. Tracking variable expenses will allow you to see where you're spending the money that is “not spoken for” by fixed expenses, debt payments and savings. It also includes entertainment spending such as going out to dinner or taking a vacation. This includes necessities that you can delay such as buying new clothes or paying for home renovations. This is spending you have control over and can adjust if necessary. The final category in your budget should be variable spending. Paying extra on your mortgage can take years off your loan and possibly save you tens of thousands of dollars in interest. You may consider paying off your mortgage. From there, a good strategy is to consider paying down your debt as one of the financial goals to be paid out of your monthly savings. Missing minimum payments damages your credit score and could lead to expensive penalties so you really need to make these payments on time. If your accounts require minimum payments, you should consider these as part of your necessary expenses. Once you decide on a savings target, you may want to schedule automatic transfers to your investment or savings accounts so you'll be sure to reach your monthly goals.ĭebt plays a bit of a mixed role in a budget allocation. It's important to put your savings aside as soon as you get each paycheck because otherwise it's very easy to spend everything and not have any money left over. This is money you're going to put aside for long-term financial goals like building your emergency fund, saving up for your college expenses, and saving for retirement. These are variable items that you can adjust when you need to.Īfter you've subtracted your necessary expenses, you should set a target savings goal out of what's left.

Remember that even items like groceries, while they need to be factored into your budget, are NOT fixed costs. This includes bills like your mortgage or rent, utilities, car payments and insurance premiums. These are expenses you absolutely have to pay each month and can't change for the time being. Once you know how much you have coming in each month, you should subtract your necessary fixed expenses from the total. If you have any other income coming in from other sources, such as stocks or a rental property, be sure to include that in your monthly total as well. Take a look at one of your pay stubs and see how much you get each month after taxes and payments for items like healthcare.

It's likely that most of your household income will be coming from the job(s) you and your spouse hold.

The first step toward planning your budget is to determine exactly how much money you have coming in. Here are some simple steps to create and maintain a household budget. By having a household budget in place, you can easily track your spending, save, and more easily monitor and reach your financial goals. Creating a budget helps you understand where your money is going each month and also allows you to develop a plan for saving. Good financial planning begins with a basic household budget.

0 kommentar(er)

0 kommentar(er)